A wallet is critical for storing your digital assets. But which one to choose between a digital asset custody wallet and a digital asset non-custody wallet will depend on your short- and long-term requirement.

Digital asset custodian wallets are preferred by newbies or users who are new to the crypto markets or less tech-savvy individuals. Such individuals generally choose the set-once-and-forget nature of managing their crypto investment. They care about accessibility over security.

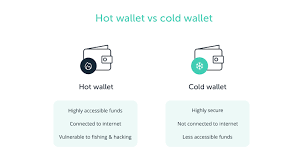

Users who often trade their crypto over exchanges usually opt for a centralized or digital asset custodian platform for storage and management purposes. Because custody wallet service providers hold your private keys on your behalf, they receive complete control and access to your entire portfolio of investments and coins. This means even if you forget your password multiple times still you can access your funds. But this is a serious security threat as well.

On the other hand, institutions, and individuals who prioritized the security of their investments over accessibility strategically opt for non-custody wallets such as Liminal multi-sig wallets. Unlike custody wallets, the non-custodial wallet allows keys-holders to exert more control over their crypto-funds and over who gets access to the crypto-investments.

When compared between digital asset custodian platforms and non-custodian platforms, it is often found that non-custodian platforms offer robust security in the long term. The only reason why users prefer keeping digital assets in custody wallets – is because custody wallets don’t require much responsibility from the user’s end, offer easy accessibility; are relatively more convenient from a trading perspective.

On the other hand, if the user becomes irresponsible and loses the password of their non-custody wallets, then there is no way of retrieving their funds back – that is financially devastating for the individual or the institution. But by using multi-sig non-custody wallets offered by Liminal, both individuals and institutions can mitigate the risk of losing their keys. Because multisignature wallets allow the user to access funds using multiple keys.

The well-known saying in the crypto-verse: “not your keys, not your coins.” If you want to abide by this rule, then opting for non-custody wallets with multi-sig features makes the most sense for you. And if you want quick access to your funds to conduct trades then opt for digital asset custodian platforms.

Liminal is among the leading enterprises offering institution-grade web3 blockchain infrastructure, such as a hot wallet crypto platform designed to assist organizations with their digital asset self-custody need.

Liminal’s digital asset custodian platform services such as trezor hardware wallet and ledger hardware wallet are developed with simplicity in mind because the team at Liminal believes that managing digital assets should not be intimidating and complex.

Liminal has built the entire web3 blockchain-based digital asset custodian platform services including a hot wallet and cold storage wallet with a security-first approach – so that you can sleep peacefully without worrying about the security of your digital assets and funds. And you also receive expert customer support from our team Liminal – to resolve challenging technical complications.